Consumer Credit Demand Decline Continues, with Credit Card Demand showing signs of recovery

Equifax NZ Consumer Credit Demand Index: June Quarter 2022

-

Overall consumer credit demand reduced by -23.6 % (vs June qtr 2022)

-

Mortgage demand reduced by -37.1% (vs June qtr 2022)

-

Unsecured credit demand down -18.3% (vs June qtr 2022)

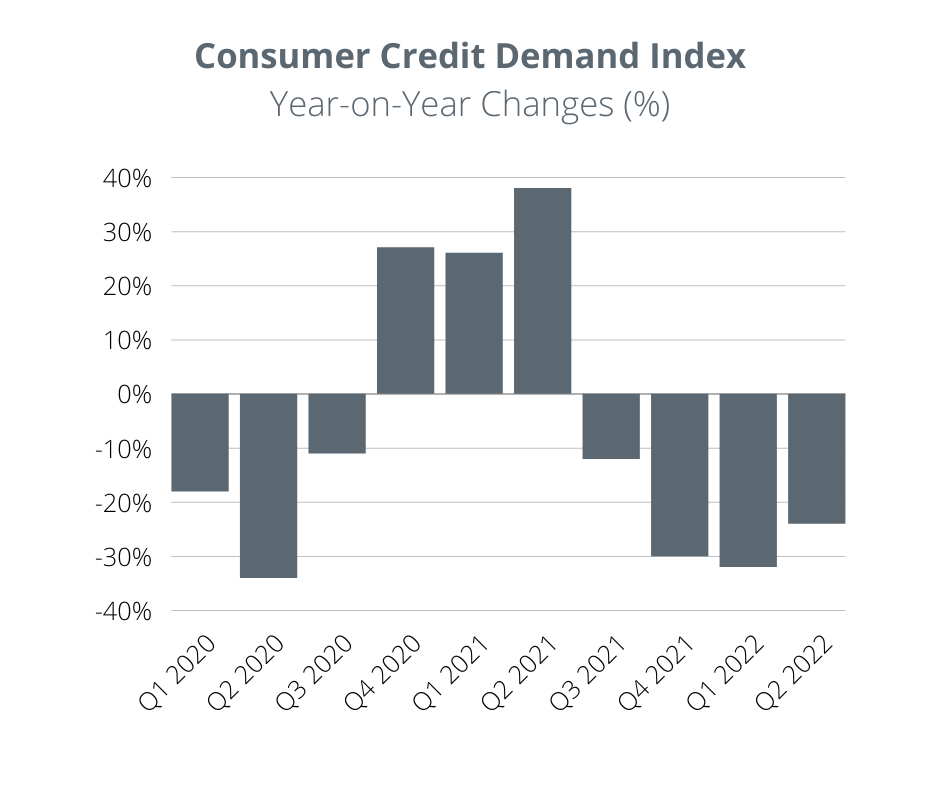

Overall consumer enquiry volumes declined for the 4th quarter in a row, with a year-on-year reduction of 23.6% for the quarter ending June 2022.

According to the latest Quarterly Consumer Credit Demand Index, while consumer credit demand has been decreasing for a number of quarters, there has been a level of stabilisation in Q2 2022. Released today by Equifax New Zealand, the global data, analytics and technology company and leading provider of credit information and analysis, the Credit Demand Index measures applications for retail credit products, including credit cards, personal loans, and home loans.

Mortgage demand experienced the biggest decline, down 37.1% for the June quarter, whilst unsecured credit demand, including personal loans and credit cards, declined 18.3%.

“The 18.3% decline in unsecured credit demand activity was largely driven by personal loan enquiries which were down 23.5% year-on-year for the June 2022 quarter. By comparison, overall card enquiries dropped by 10.4% for the same period, an improving trend on recent quarters”, said Angus Luffman, Managing Director Equifax New Zealand.“

“The improving trend in credit card demand was largely driven by activity from the major metropolitan based regions of Auckland, Canterbury and Wellington. Since the start of 2022, there is stronger demand for bank-issued credit cards, as against store and finance cards which have continued to decline in the most recent quarter.” Mortgage demand for the June quarter dropped by 37%, year on year, continuing the recent trend, with the biggest falls in demand occurring in Gisborne (down 47.4%), Tasman (down 42.3%), Wanganui (down 41%).

“There are multiple drivers impacting mortgage demand, be it OCR and cost of living increases or tighter responsible lending regulations under the CCCFA. There is still a degree of the impact that reflects activity withdrawing from the record high mortgage demand seen in late 2020 and through the first half of 2021. Despite the softening market, mortgage demand in the June quarter 2022 was still 8.6% higher than the same quarter in Q2 2019.”

NOTE TO EDITORS

For more information, please contact:

Serena Benson 022 077 0767 – info@serenabenson.com

ABOUT EQUIFAX INC.

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employees, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by more than 11,000 employees worldwide, Equifax operates or has investments in 25 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit www.equifax.co.nz or follow the company’s news on LinkedIn.

DISCLAIMER

Purpose of Equifax media releases:

The information in this release does not constitute legal, accounting, or other professional financial advice. The information may change, and Equifax does not guarantee its currency or accuracy. To the extent permitted by law, Equifax specifically excludes all liability or responsibility for any loss or damage arising out of reliance on information in this release and the data in this report, including any consequential or indirect loss, loss of profit, loss of revenue or loss of business opportunity.